This is the bank's standard checking account for everyday banking. The $15 monthly maintenance fee is waived if you keep a minimum daily balance of $100. There's also no monthly maintenance fee for students aged 17 to 23. Another basic account, TD Simple Savings offers simple banking features for individuals who want to maximize their savings but don't need access to premium banking services. The savings account carries a $5 monthly fee waived by keeping at least a $300 minimum daily balance.

You can also waive fees for the first year by setting up a recurring $25 or more transfer from a linked eligible TD Bank checking account. Customers under 18 or over 62 years of age also get TD Simple Savings fees waived. The TD Convenience CheckingSM account is a basic checking account that includes online and mobile banking and a debit card.

Other account holders need to meet a fairly low minimum balance requirement to waive the monthly fee. If you don't normally keep a lot of money in your account, you may be better off with a checking account that doesn't have any minimum balance requirements. TD Bank offers student checking accounts for those between the ages of 17 and 23 who are full-time students. However, when you turn 24, the bank account will automatically transition to a Convenience Checking account, where you must abide by the minimum daily balance required or pay a monthly maintenance fee.

Therefore, as you get close to your 24th birthday, keep an eye on your balance and current guidelines for the standard TD checking account so that you don't get hit with unexpected account fees. This is a checking account with more perks and features than Convenience Checking, but you need to have a more significant banking relationship with TD Bank to make it worthwhile. Qualifying customers with the TD Beyond Checking account also get free ATM transactions at non-TD Bank ATMs, two free overdraft fees per year and other perks like free standard checks. The Beyond Checking account also pays interest, but the APY is currently 0.01%.

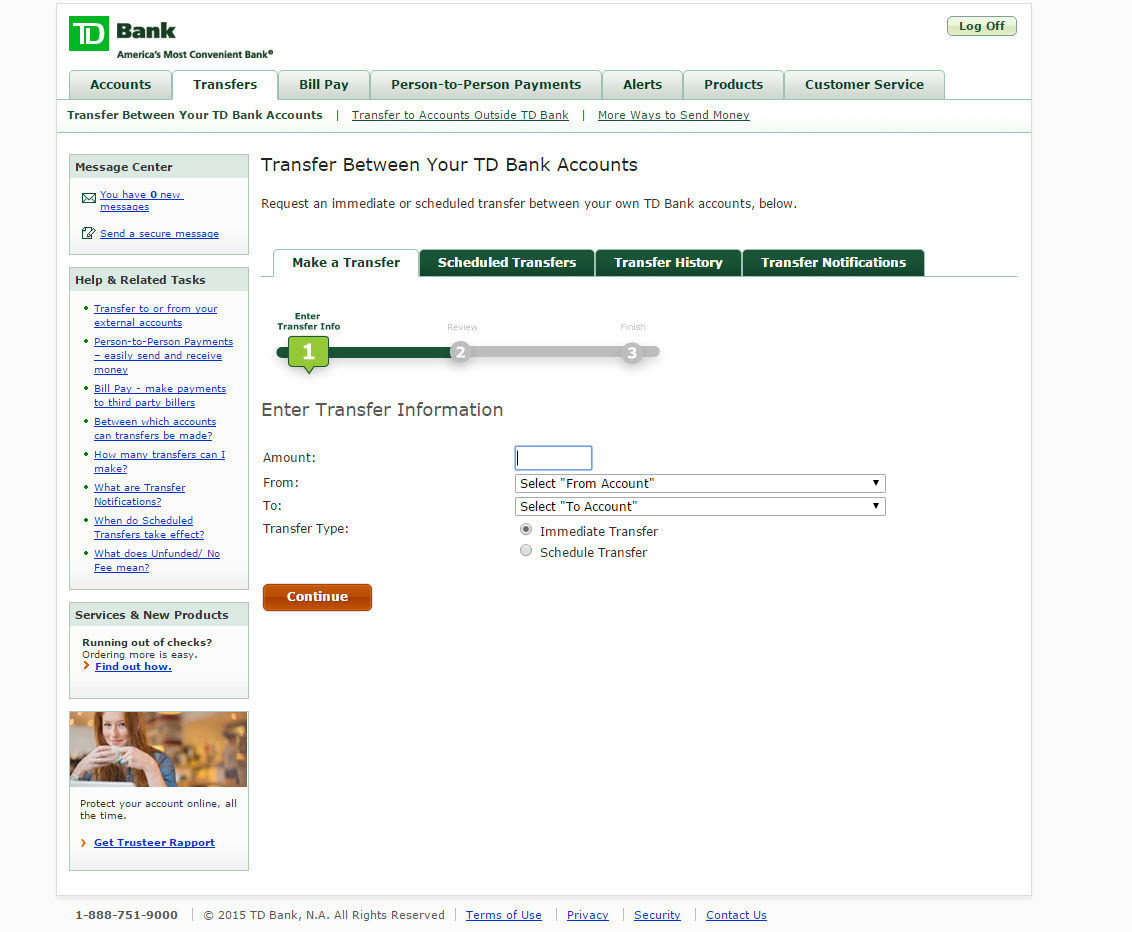

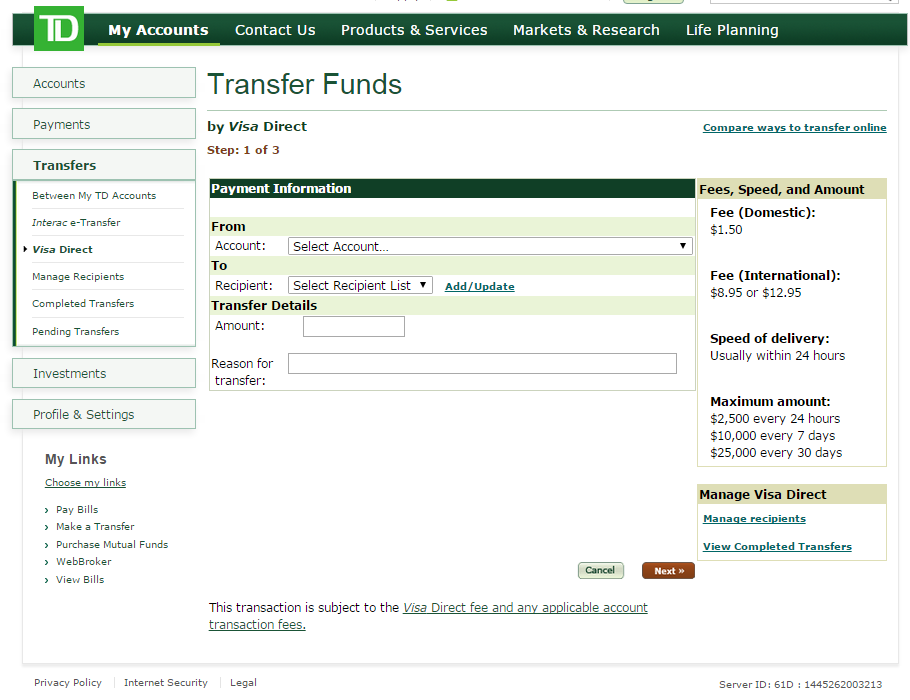

6Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required.

Message and data rates may apply, check with your wireless carrier. Must have a bank account in the U.S. to use Send Money with Zelle®. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. This account is aimed at businesses with relatively low levels of turnover and straightforward business needs. It doesn't need a high deposit to open the account, and the monthly fee is lower than for the other two checking accounts we cover here.

You'll also get a TD Bank Visa debit card and 24/7 online banking, as is the case for all these accounts. TD Bank Online banking services have made it easy for customers to bank any time provided they have enrolled for free services. Customers can also access their bank accounts online on their mobile web browsers or by downloading the mobile app of playstore and itunes. This guide will direct you on how to access your online account, how to reset the password in case you want to and enrolling for the internet banking services. Customers who open a new TD Convenience Checking account and make at least $500 in direct deposits within the first 60 days will qualify for a $150 TD Bank checking account bonus. The Convenience Checking account is best for students, young adults or customers who can't meet the minimums required by TD's Beyond Checking account.

There is no monthly maintenance fee for students, young adults or account holders who maintain a $100 minimum daily balance. Account holders who don't meet these requirements are subject to a $15 monthly account maintenance fee. This guide will help you create the TD Bank login you'll need to access these features. However, the Beyond Checking account offers a wider range of benefits. Banking customers have a few ways to waive their monthly fees.

They can meet the minimum daily balance, as explained, hit a monthly direct deposit minimum, or meet a minimum balance across all their eligible TD bank accounts. This account also offers no ATM fees and reimbursement on some wire transfers. Holders can even get reimbursed for overdraft fees two times per year.

3Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number, an active unique e-mail address, and a Social Security Number. This account is designed for businesses which have a moderate level of transaction activity. It offers some extra features over Simple Checking, such as the ability to waive the monthly maintenance fee if you keep your balance high enough. It may also offer rewards if you link your account with a personal checking account — details may change, so be sure to check the latest details.

You will pay quite a bit more each month for these extra features, though, and the minimum starting balance is also higher. All checking accounts charge monthly maintenance fees, but most of those fees can be waived by maintaining a minimum balance or making monthly deposits. The only account that does not offer the ability to waive the fee is the TD Simple Checking account, but it also does not require a minimum daily balance. You will need to maintain a minimum account balance in order to waive a fee. Similarly, the monthly fees under Chase's checking and savings accounts are waivable.

There is a $5 monthly maintenance fee for this account, which the bank will waive if you maintain a $300 minimum daily balance or link your savings account to a qualifying TD Bank checking account. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. I mentioned there are ways to waive your account's monthly fee, but Beyond Checking also waives fees on other select TD Bank accounts.

You receive a fee waiver on one other TD personal checking account and any savings or money market accounts. This account is aimed at businesses that need to deal with greater levels of turnover. It offers much higher limits on deposits each month before an additional fee is charged, and there's a lower per-item fee if you go over the included transaction limit. You'll also get your first three monthly maintenance fees waived automatically. This account also waives the fee for using non-TD ATMs, though the ATM company itself may still charge its own fee.

In return for these extra features, you'll pay the highest monthly fee of the three checking accounts, and the minimum opening deposit is also quite a bit higher than for the other two. TD Bank is a full-service bank that offers loans, credit cards and other financial products. If you have a checking account with them, it may provide you with a better deal on a personal loan, a mortgage or other financial accounts. It places a strong emphasis on customer service and makes it easy to contact customer service via in-app communication, social media channels, as well as email or phone. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address and a social security number. Download our mobile app to get on-the-go access to your accounts and bank securely 24/7.

Anywhere you are, view your balance, deposit checks, send money, transfer funds, pay bills and more. TD Bank provides great customer service and rewards its loyal customers with rare perks. For example, you can get discounts on loans if you open multiple accounts. It also offers a good variety of products and services, including savings accounts that give you direct access to your cash when you need it. Most conventional bank accounts charge a monthly maintenance fee, and TD Bank's checking accounts are no different. When you pay this fee, it covers you for a certain number of transactions each month.

You may also get other bonuses, depending on the account type you pick. Once again, look carefully to see how each account differs, as some features may have limits that exceeding will cost you extra. The flip side of that is that, with some account types, if you keep a high enough balance in your account, the monthly fee may be waived. Both TD Bank and Chase offer savings accounts, checking accounts, CDs, IRAs and convenient mobile features, but they offer different interest rates. For savings accounts, TD Bank provides the TD Simple Savings and the TD Preferred Savings accounts. The TD Simple Savings account functions as the bank's most basic savings account.

It allows you to open the account with any deposit amount. Once you open the account you begin earning at a 0.05% APY. The Preferred Savings account, however, allows you to earn at a higher interest rate when you have a higher account balance. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, and an active unique e-mail address. 1Send Money with Zelle® is available for most personal checking and money market accounts. Having a linked TD Bank personal or business checking account, a mortgage, a home equity loan, or a credit card unlocks TD Relationship Bump rates.

If you want the best rate TD Bank offers, you'll need a whopping $250,000 minimum balance. The tablet enables users to manage their personal bank accounts and check their balances and transactions for checking, saving and money market accounts. TD Bank has found that consumers prefer online banking on tablets due to the wider screen and easier ability to see figures and details. If you have higher monthly direct deposits and a bit more liquid cash to spare, you can earn a higher bonus with TD's Beyond Checking account.

Customers who open a new Beyond Checking account and make at least $2,500 in direct deposits within the first 60 days will qualify for a $300 cash bonus. The Beyond Checking account is best for customers with consistent direct deposits over $5,000 per month or who can maintain a daily balance of $2,500 or more. Account holders who cannot meet the minimum daily balance or direct deposit requirements are subject to a $25 monthly account maintenance fee. TD Bank is currently offering a couple of checking account promotions for customers who open new accounts. To qualify for the TD Bank sign up bonus, customers must open the new account and meet certain deposit requirements.

Once customer eligibility and completion of the offer requirements have been verified, TD Bank will deposit the applicable cash bonus into your new bank account within 140 days. A TD Bank account requires only basic information to set up and offers a variety of perks. While each account charges monthly fees, you can waive most fees by meeting certain criteria. If you're looking for reliable banking services with quality customer support, consider opening a checking, savings, or money market account with TD Bank.

TD Bank offers several checking account options, including a student checking account that will benefit many different customers. These accounts generally work best for those who can meet the requirements for waiving maintenance fees, either as a student or by maintaining a minimum daily deposit. This option can work well for those who meet the monthly requirements to waive the monthly maintenance fee, for example, established professionals who are enrolled in direct deposit. However, students who may struggle to meet the requirements to waive the fee on the Beyond Checking account will find that Convenience Checking offers an excellent option.

The Convenience Checking account comes with a waived minimum balance, no monthly fees and free overdraft protection. With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. With the app, you can view balance and transactions, make transfers, send and receive money, deposit checks, pay bills, view online statements and more. TD Beyond Savings offers higher rates for those with an eligible linked personal or small business checking account, mortgage, home equity loan or credit card. Interest rates are based on location and also your account balance.

This checking account is geared towards individuals ages 60 and older. 60 Plus Checking is an interest-bearing account with a $10 monthly fee waived with a $250 average daily balance. The account also comes with free checks, money orders and paper statements. While most of the banking world, including TD Bank, is moving to more digital banking methods, it's nice to see an account that still offers some of the conveniences of banking past for free.

A basic checking account, Simple Checking features no minimum balance and a $5.99 monthly fee. The account comes with a free contactless debit card, a discount on your first set of checks and a 0.25% discount on TD Bank home equity loans and personal loans. Banks often try to attract new customers by offering limited-time bank bonus promotions. The promotions usually require opening a new bank account and meeting balance or deposit requirements. TD Bank is currently offering two bank bonuses that can net you up to $300 for opening select checking accounts and reaching specific direct deposit goals in the allotted time frame.

The TD Beyond Checking account is an interest-bearing checking account. It includes free checks and reimbursements for out-of-network ATM fees and two overdraft fees per year. You need a larger balance to avoid the monthly maintenance fee, though. It's not a good fit for those who don't keep a fair amount of money in their checking accounts.

Your next move is to find out about the fees and limits that the account you're looking at imposes. These can vary a lot between accounts, so this is a really important step. You'll also want to check to see whether there are charges for things like making a lot of deposits, using ATMs outside the bank's own network, or making international transactions. As with many other bank cash back bonus offers, TD Bank's current promotions are only open to new customers. TD Bank defines a new customer as customers who do not have a current checking, savings or money market account and who have not had one within the previous 12 months. To be eligible for any of these promotions, you must also open your account online through one of the designated offer links.

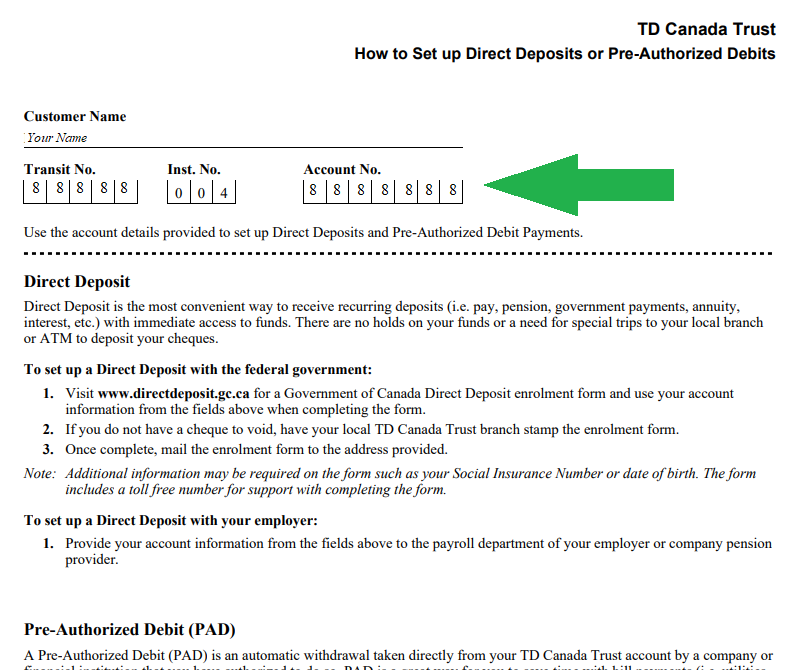

Additionally, you will need to have your bank account information ready, including your routing and account numbers. The next step is to select the type of account that you want to enroll for TD online banking. You can enroll your personal, small business account, or both your personal and small business accounts.

TD bank will then ask you to confirm that you are the owner of these accounts. The bank fees from TD Bank and Chase differ depending on a number of factors. The TD Simple savings account requires $5 for monthly fees, but $4 if you sign up for online statements. The TD Preferred Savings account, however, charges a monthly fee of $15 for paper statements, but $14 for online statements. If you're looking for a no-frills checking account, the TD Simple Checking has a $5.99 monthly maintenance fee no matter how much you have sitting in the bank. You get just the basics with this checking account, such as free online statements and free access to TD's mobile bank app.

If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee. However, if you want the convenience and accessibility of banking at a larger regional bank with a footprint throughout the East Coast, TD Bank offers some valuable features and benefits. The mobile app is highly rated and well designed for everyday banking.

It offers convenient features like compatibility with digital wallets, mobile check deposit and the ability to send money with Zelle. Money market accounts are hybrid bank accounts that offer the best features of savings and checking accounts. TD Growth Money Market is an interest-bearing account that gives customers access to helpful features such as check writing and ATM use. Beyond Savings is a savings account with tiered interest rates based on your account balance.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.